Navigating Lesser-Known EU Sanctions: A Focus Beyond Asset Freeze

- By Pierre Simon

- 24 October 2023

The European Union (EU) has imposed an extensive array of 290 restrictive measures, also known as sanctions, addressing various global issues. While the asset freeze measure stands out as the most well-known, given its frequent mentions and the need to screen against a lengthy list of thousands of sanctioned individuals and entities on EU sanctions lists, this article turns the spotlight onto the less recognized, but equally significant, restrictive measures. EU sanctions impact a wide range of sectors, including insurance, which we will explore in the context of lesser-known measures. Additionally, we will delve into investment-related sanctions and strategies for the insurance industry to comply and mitigate the risk of sanctions violations.

Understanding EU Sanctions: Beyond Asset Freeze

While asset freeze measures have garnered significant attention, there are other vital and less-publicised EU sanctions that require our focus.

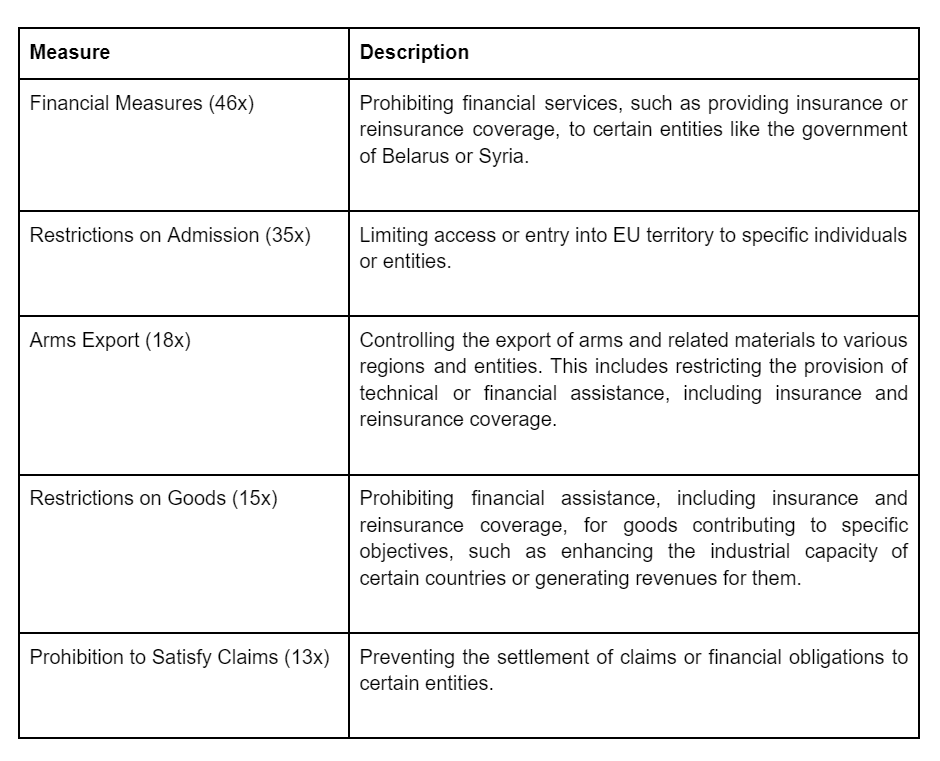

The EU has imposed financial measures, restrictions on admission, arms export controls, restrictions on goods, and prohibitions to satisfy claims on certain entities, such as the governments of Belarus and Syria. These measures are designed to prevent these entities from accessing financial resources, entering EU territory, exporting arms, or importing goods. They also aim to prevent these entities from settling claims or financial obligations.

Here is a table summarizing the measures:

Exploring Lesser-Known Sanctions

As mentioned before, the asset freeze is the most well-known EU sanction, but it is only one of a range of measures that the EU uses to achieve its foreign policy objectives. Other lesser-known sanctions, such as financial restrictions, restrictions on admission, arms export controls, restrictions on goods, and prohibition to satisfy claims, can have a significant impact on targeted individuals and entities.

For example, financial restrictions can prevent targeted individuals and entities from accessing their own money or from using financial services. Restrictions on admission can prevent targeted individuals from entering the EU. Arms export controls can prevent the sale of arms to targeted individuals and entities. Restrictions on goods can prevent the sale of certain goods to targeted individuals and entities. Prohibition to satisfy claims can prevent targeted individuals and entities from collecting debts that are owed to them.

These sanctions can have a significant impact on the targeted individuals and entities, as they can make it difficult for them to carry out their daily activities. They can also have a wider impact on the economy of the country or region where the targeted individuals and entities are located.

This section explores these lesser-known sanctions in more detail, explaining their purpose, impact, and implications for the insurance industry.

Financial measures

These measures affect the insurance and reinsurance industry by restricting their involvement with entities in countries under sanction, such as Belarus and Syria. Insurance companies need to navigate these complex financial restrictions and avoid violations to prevent substantial financial penalties and reputational damage.

Example:

EU sanctions prohibit European insurance and reinsurance companies from providing insurance coverage, reinsurance coverage, or financial assistance to sanctioned Belarusian and Syrian banks and government entities.

Restrictions on Admission

These measures limit access by certain individuals or entities to EU territory. Understanding and adhering to these restrictions is essential, as violations can lead to legal consequences.

Example:

To follow EU travel restrictions, insurance and reinsurance companies cannot provide any travel-related services to sanctioned individuals or entities, such as travel insurance, booking flights or hotels, or arranging visas. Insurance companies also cannot invite sanctioned individuals to attend shareholder meetings, even if the individual is a shareholder of the firm.

Arms Export

EU arms export sanctions prohibit the export of arms and related materiel to Belarus, the Central African Republic, the DPRK (North Korea), all non-governmental entities and individuals operating in the territory of the Democratic Republic of Congo (DRC), Lebanon, Myanmar (Burma), Russia, South Sudan, Sudan, the listed individuals, groups, undertakings or entities, Venezuela, and the listed persons and entities. They also prohibit the provision of related technical or financial assistance, including the provision of insurance and reinsurance coverage, and services.

This overview covers all 18 restrictive measures related to arms exports, including the prohibition on providing related technical or financial assistance. The prohibition on providing related technical or financial assistance is particularly relevant to the insurance industry, as it means that insurance companies cannot provide insurance or reinsurance coverage for the export of arms and related materiel to sanctioned countries and entities.

Here are some examples of how the arms export sanctions could apply to insurance companies:

- An insurance company cannot provide insurance coverage for the shipment of arms to Russia.

- An insurance company cannot provide reinsurance coverage to another insurance company that is providing insurance coverage for the export of military equipment to Sudan.

- An insurance company cannot provide financial assistance to a company that is involved in the production of arms for the DPRK.

Example:

An insurance company cannot provide insurance coverage for the export of arms or military equipment to a country that is subject to EU sanctions, or for the construction of a military base in such a country. Nor can it provide reinsurance coverage to an insurance company that is providing insurance coverage for such activities.

Restrictions on Goods:

EU restrictions on goods prohibit the provision of financial assistance, including the provision of insurance and reinsurance coverage, related to sanctioned goods which could contribute to the enhancement of Russian industrial capacities, goods which generate significant revenues for Russia, equipment or technology to Syria, goods originating in Crimea or Sevastopol, goods and technology to entities in Crimea or Sevastopol, or goods originating in the specified territories.

This overview covers all 15 restrictive measures related to goods, including the prohibition on providing financial assistance. The prohibition on providing financial assistance is particularly relevant to the insurance industry, as it means that insurance companies cannot provide insurance or reinsurance coverage for certain types of goods.

Here are some examples of how the restrictions on goods could apply to insurance companies:

- An insurance company cannot provide insurance coverage for the shipment of sanctioned goods to Russia or Syria.

- An insurance company cannot provide reinsurance coverage to another insurance company that is providing insurance coverage for the export of goods which generate significant revenues for Russia.

- An insurance company cannot provide financial assistance to a company that is involved in the production of goods which could contribute to the enhancement of Russian industrial capacities.

Example:

An insurance company is approached by a customer who is looking for insurance coverage for a shipment of goods (i.e. equipment or technology) from Antwerp to the port of Latakia in Syria. The insurance company’s underwriter does not realise that the goods are sanctioned. The insurance company issues the insurance policy.

In this example, the insurance company has violated the restrictions on goods by providing insurance coverage for sanctioned goods. Even though the underwriter was not aware of the sanctions, the insurance company is still liable for the violation.

An insurance company cannot provide insurance coverage for the shipment of goods subject to EU sanctions, such as equipment or technology to Syria, or for companies involved in the construction of power plants in Syria or the production of chemical weapons, as this would be considered financial assistance.

Prohibition to Satisfy Claims

These measures disallow the settlement of claims or financial obligations to certain entities. Understanding which entities are subject to these restrictions is crucial for the insurance industry.

Example:

An insurance company cannot pay a claim to a company or person that is subject to EU sanctions, or for a transaction that is prohibited by EU sanctions.

These are just a few examples of how the lesser-known EU sanctions can impact the insurance industry. It is important for (re)insurance companies to be aware of all applicable sanctions and to take steps to ensure that they are complying with these sanctions.

Investment-Related Sanctions

In addition to the lesser-known measures, EU sanctions also include investment-related restrictions:

- Ban all EU investments in the Democratic People’s Republic of Korea (DPRK) in all sectors.

- Prohibition of activities like granting financial loans or credit, acquiring or extending participation, and creating joint ventures with enterprises engaged in specific sectors, such as Syria’s oil industry or the construction of power plants for electricity production.

- Prohibiting investment in the Syrian oil and natural gas industries and the construction of power plants for electricity production.

- Prohibition of acquiring or extending participation in real estate and entities in Crimea or Sevastopol.

- Prohibition of acquiring or extending participation in entities in Crimea or Sevastopol and other related securities.

- Prohibition of acquiring or extending participation in the ownership or control of entities in specified territories and related securities.

Here is an example of how an insurance company could violate investment-related sanctions without realising it:

An insurance company is looking for a new investment opportunity. The company’s investment manager identifies a company that is registered in a country that is not subject to EU sanctions. The investment manager does not realise that the company is owned by a person who is subject to EU sanctions. The insurance company invests in the company, and the investment manager receives a bonus for their work.

Insurance companies should take steps to ensure that they are complying with all applicable sanctions, including investment-related sanctions. This includes having a robust sanctions compliance program in place to screen all potential investments against EU sanctions lists.

Understanding Compliance and Mitigation

Compliance with EU sanctions is paramount for the insurance industry to avoid financial penalties and reputational damage. Here’s what insurance companies can do to comply and mitigate sanctions violations:

- Implement Comprehensive Compliance Programs: Develop and implement robust sanctions compliance programs, including risk assessments, screening procedures, and employee training.

- Utilise Sanctions Screening Software: Employ specialised screening software to check customers, transactions, and data against EU sanctions lists.

- Conduct Due Diligence: Thoroughly assess customers and business partners to ensure they are not subject to sanctions.

- Stay Informed: Monitor EU sanctions developments and update compliance procedures accordingly.

By adhering to these strategies, the insurance industry can effectively navigate the challenges posed by EU sanctions and mitigate associated risks.

Conclusion

In conclusion, EU sanctions are a complex and ever-changing landscape, encompassing a range of measures beyond the commonly known asset freeze, impacting various industries, including insurance. Besides lesser-known measures, investment-related sanctions add another layer of complexity. It is therefore important for the insurance industry to be aware of the latest developments and to implement robust compliance programs to avoid legal consequences. Some key things to keep in mind include:

- EU sanctions can apply to a wide range of activities, including investment-related activities.

- Sanctions can be imposed on individuals, entities, and countries.

- Sanctions can be imposed for a variety of reasons, including human rights abuses, terrorism, and nuclear proliferation.

- Compliance with EU sanctions is essential to avoid legal consequences.

- The insurance industry can proactively manage these challenges by implementing robust compliance programs, utilising screening tools, conducting due diligence, and staying informed about sanctions developments.

By following these tips, the insurance industry can help to ensure that it is compliant with EU sanctions and avoid any potential legal consequences.

- Pierre Simon

- 24 October 2023