A view on an ever increasingly popular method of laundering illicit funds – “In the world of mules…”

- By Rochelle Bence

- January 31, 2023

“In the world of mules, there are no rules” – if only we knew how true this short poem by Ogden Nash would prove to be. In the realm of money laundering and specifically where it concerns the use of money mules as a technique to conceal illicit funds, there really are no rules.

Although money mules can be used during either the first (placement) or second (layering) stage of money laundering, money mules are predominantly used during the layering stage, whereby criminals conceal the origin of illicit funds by using money mules as a technique to wash, integrate and circulate illicit funds back into the formal legal economy.

With money mules becoming an increasingly popular method to launder money, especially within the context of cybercrime, we’ve had a look at the largest initiative aimed at curbing the use and recruitment of money mules.

Define ‘money mule’

There are numerous definitions in circulation for the term ‘money mule’, some with a narrow scope, and others with a somewhat wider scope. For the purpose of this article, however, Europol defines a money mule as “a person who receives money from a third party in their bank account and transfers it to another one or takes it out in cash and gives it to someone else, obtaining a commission for it.”

Excluding those instances where individuals have willingly and knowingly consented to being a money mule, we frequently come across instances in which i) individuals are either somewhat aware or in the alternate, completely unaware of the fact that they are participating as a money mule; or ii) individuals are tricked or blackmailed by criminals to launder funds on their behalf.

Although a money mule may not necessarily be directly involved in the activities from which illicit funds are derived, they are complicit to, and play an extremely vital role in the overall facilitation of the money laundering process, in which they essentially act as an enabler of the anonymity which criminals get to enjoy.

Clamping down on money mules

The end of November 2022 marked the conclusion of the 8th edition of the European Money Mule Action (“EMMA”).

The EMMA, led by the Netherlands and established in 2016, is an ongoing operation conducted under the umbrella of EMPACT Cybercrime Payment Fraud Operational Action Plan. It is driven and facilitated by Europol, Eurojust, and the European Banking Federation (“EBF”), and focuses its attention on the fighting of complex modern crimes by way of public private information sharing and is the largest known international initiative of this nature.

The initiative involves various law enforcement agencies with the support of the entities mentioned in the preceding paragraph. The intelligence exchange facilitated by this operation has not only created a renewed sense of awareness around money mules, but has in addition enabled law enforcement agencies to correctly and successfully identify money mules and has further ushered in a very welcome increase in the number of money mule arrests over the past few years.

A brief overview of the 8th edition of the EMMA

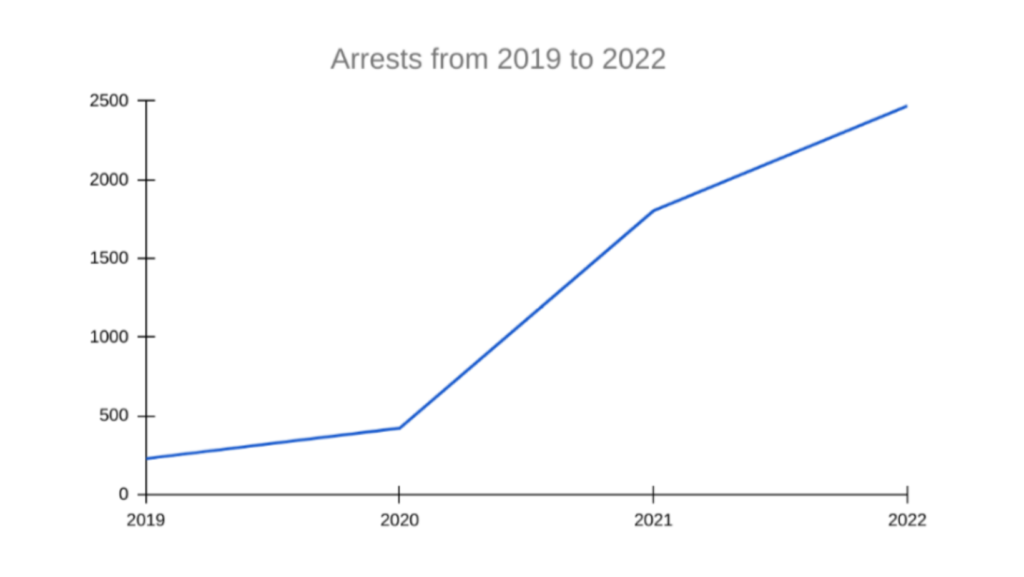

The EMMA’s unique approach to, and strategy in combating money muling has proven to be quite successful as we have seen a significant increase in money mule specific arrests from 2019 to 2022. Looking at the overall results between 2019 and 2022, there have been a number of fluctuations, either upward or downward, however the results in general prove to be promising of the future ahead, especially when those results pertaining to the year-on-year increase in the number of money mule arrests.

In 2019, 228 money mule arrests were made, which pales in comparison to the staggering 2.469 arrests in 2022.

In addition to the arrests, the EMMA’s labor speaks for itself as we saw the:

- Interception of EUR 17.5 million;

- Identification of 222 money mule recruiters;

- Identification of 8.755 money mules;

- Initiation of 1.648 criminal investigations; and

- Identification of 4.089 fraudulent money mule transactions.

Notes to be taken from the kick of a mule

Despite the fluctuation in results, and on whatever account it may be, we seem to be making very good headway when it comes to the combating of money muling.

Creating awareness amongst roleplayers within the industry but also under the general public is and should remain key.

It is evident from collaboration intensive initiatives such as the EMMA, that combined cross border collaboration remains one of the (if not the) most effective ways in which the laundering of illicit funds, by the use of money mules, may be combated.

With criminals becoming increasingly creative in the ways in which they launder illicit funds and recruit individuals to do so on their behalf, it really is important, now more than ever before, to learn from the kick of a mule.

- Rochelle Bence

- 31 January 2023